January Housing Market Update

With the new year officially here, we'd be remiss if we didn't take the opportunity to wish you a happy new year! We hope you, your family, and your loved ones are well. Here at 5 Elements Real Estate Advisors, we are excited to launch into the pre-spring housing market. Read on for featured properties, a year-in-review, and a 2026 outlook.

2025 Year-in-Review

Since the onset of the pandemic in 2020, the real estate market has experienced a series of “historic” years. 2025 was no exception. In the DC-metro area, this year felt less about dramatic swings and more about constant adjustment, shaped by economic headlines, policy changes, and evolving buyer behavior.

A Year of Uncertainty

The year began with uncertainty in the housing market as buyers and sellers continued to weigh economic conditions and broader policy developments. National housing activity showed mixed signals in early 2025, with ongoing conversations around tariffs and broader economic policy keeping some buyers on the sidelines.

As we moved into the fall, market sentiment was further influenced by job reports and concerns about the government shutdown; issues that tend to weigh more heavily in the DC region than in many other markets.

Inventory Increases

Despite this uncertainty, inventory told a different story. Listings across the DC-metro area increased noticeably in 2025, with data showing active listings jumped over 25% year-over-year in the spring, reaching the highest levels seen since 2022. This gave buyers more choices than they’ve had in recent years and reduced some of the urgency that defined earlier post-pandemic markets.

The result? A more balanced, but nuanced, market. Well-priced, move-in-ready homes still attracted strong interest and, in some cases, multiple offers. At the same time, other listings sat on the market longer than sellers expected. Buyers are clearly still active, but they are more selective and more deliberate, unwilling to overpay or compromise as quickly as they might have in prior years.

Before we tie a bow on 2025, read on to explore what's next for the 2026 housing market.

What's Next for the 2026 Housing Market?

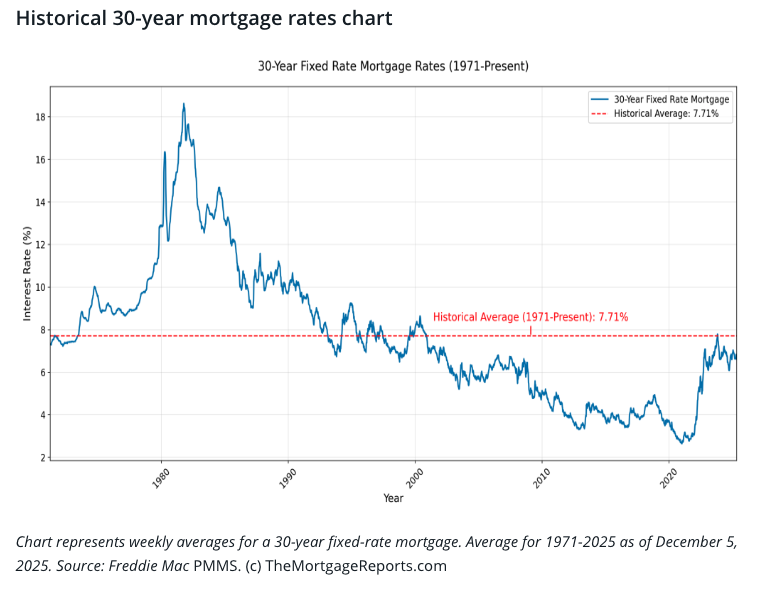

Interest rate trends will play a central role in shaping the 2026 market. After peaking earlier in the year, the average 30-year fixed mortgage rate eased to just over 6% toward the end of 2025, according to Freddie Mac. In early 2026, the rates have since dipped further into the high 5%.

While this decline from mid-year highs has improved affordability slightly, mortgage rates remain elevated compared with the pre-pandemic era, and many buyers continue to shop carefully as a result. Unless rates continue to move downward, buyer caution and value-driven decision-making are likely to persist into 2026.

Potential for Increased Activity

Still, the backdrop for 2026 shows potential for increased activity. Elevated inventory throughout 2025 in the DC-metro area gave buyers more options and softened some supply-driven pressures.

With more choice and even modestly lower borrowing costs, buyers who paused in 2025 may return with more confidence in the spring market, and sellers who have held back could decide now is the time to list. Analysts project that housing trends in 2026 will be steadier, with mortgage rates expected to hover around current levels or dip slightly as economic conditions evolve, supporting a more balanced market environment.

We are already beginning to see signals of a strong spring market, with multiple offers on attractive properties that are priced competitively. The number of new listings is also increasing, and early predictions anticipate a larger number of new listings this spring than we saw last spring.

One thing remains clear: strategy, pricing, and preparation will be more important than ever for both buyers and sellers as we enter the spring market.

Reach out for a free, no-obligation consult at 703.677.0709 / fenny@kw.com.